The B2B edge opportunity for telecoms operators

By Richard Lim, a consultant at STL Partners

Edge computing has been a key area of interest amongst enterprises and operators alike. This in part due to edge’s potential to enable a new set of advanced use cases that span across multiple verticals including autonomous manufacturing, cloud gaming, or even the home. As these use cases mature, operators see this as an opportunity to capture more value in the B2B segment, offering services that can diversify their revenue streams – whether these are different verticals, geographies, or even larger parts of the value chain.

STL Partners sees two relevant types of edges. Firstly, network edge or multi-access edge computing (MEC), where operators offer edge services via edge data centers on the telco network, or on-premise edge, where edge services are offered through physical compute platforms at customer premises. However, the edge market is still nascent, and operators need to define a winning strategy. STL Partners’ recent report, “Growing B2B revenues from edge: Five new telco services,” outlines the potential options available to telecoms operators.

The three different operator strategies and philosophies

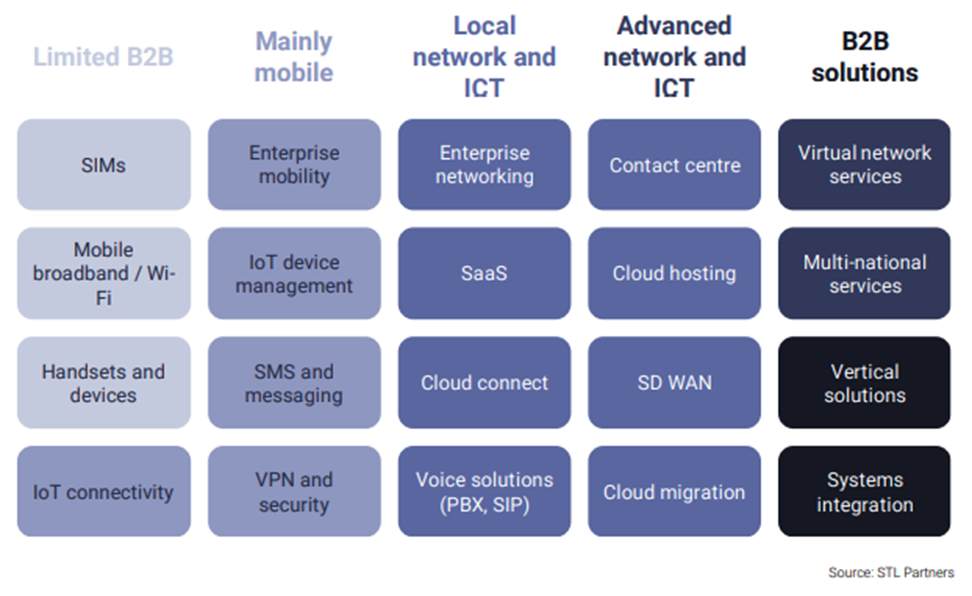

Defining this strategy is not simple, as it is dependent on an operator’s B2B maturity. Some operators have largely focused on the B2C segment, mainly offering SIMs and basic connectivity in B2B. On the other end of the spectrum, telcos with more established B2B businesses are providers of full vertical solutions who have the resource and expertise to even play the role of systems integrators themselves. This naturally influences the extent of their existing enterprise relationships, the diversity and relevance of their partner ecosystems, the complexity of the solutions they can offer, and their ambitions.

Figure 1: The different levels of B2B maturity

Through our conversations with operators and our research: Growing B2B revenues from edge: Five new telco services, we identified three overarching strategies operators are taking.

Strategy 1: Moving up the value chain

This play is usually limited to incumbents who already have a mature enterprise business and subsequently, relationships across government, enterprises, and small-medium enterprises (SMEs). These larger players see edge as an opportunity to position themselves as a ‘one-stop shop’ for all an enterprise’s technology needs, effectively increasing the average revenue per customer by capturing a larger part of the value chain. This typically involves offering more ‘complex’ services that span out of pure connectivity, such as advanced networking or software-as-a-service (SaaS). As these typically require greater resources to develop and deliver, smaller operators struggle to provide the significant upfront investment needed.

Strategy 2: Extending the core business

Some operators prefer to stay true to their core competencies, focusing on enhancing their connectivity business. As applications evolve and the demand for lower latency and/or reliability grows, so does the need for edge computing. This demand will drive an increase in the number of edge sites across the network as well as the number of devices per edge site – fueling revenue growth for operators. Generally, operators who are interested in this strategy are those with established multi-national network services who see this as the easiest leap forward, leveraging their existing infrastructure and know-how, to enter the edge market.

Strategy 3: Serving new markets

This strategy is reserved for players who have less established B2B businesses and see this as a lower-cost opportunity to capture the enterprise edge. The players would focus their efforts around on-premise edge offerings. By avoiding large edge network infrastructure roll-outs as in a network edge strategy, the huge upfront investment can be avoided, and therefore operators can more safely build up their expertise within a specific customer segment before expanding into broader markets.

Another opportunity is within the developer segment, which has typically been underserved by operators. Developers need flexibility and agility to support rapid innovation cycles, therefore by providing platform-based solutions with consumption-based models, developers could be an untapped market. Delivering this with a value proposition tied around edge computing will be a valuable opportunity some operators will seek to unlock. Typically, this service will be a more attractive option for operators who have a unique proposition e.g., they already have an extensive network of edge sites in their market or they are facing limited competition e.g., from hyperscalers.

The five types of B2B edge services

As operators are all at different starting points, their ambitions and the services they want to and can offer will vary. From speaking to operators, in combination with our research on our edge practice, STL Partners has identified five types of edge services that operators are developing to serve B2B customers.

Figure 2: Five types of B2B edge services

Edge-to-cloud networking

This service involves offering enhanced network services to optimize connectivity between devices or premises to edges and clouds, meeting more stringent requirements of edge applications and customers such as latency, security, or reliability. Maintaining the same levels of quality of service can be complicated, especially with the fragmentation of edges and clouds, plus applications running across different premises or cloud vendors. The customer base of these services is usually an operator’s existing enterprise customers and therefore would appeal to operators who seek to build on their core businesses.

Private edge infrastructure

This service involves providing the physical infrastructure and the software layer for enterprises to run applications on, paired with network services. Operators largely see private edge or on-premise edge as the nearer term enterprise opportunity because it requires lower upfront investment as compared to network edge (which requires an extensive infrastructure roll out to scale). The customers for these are usually within an operator’s existing customer base and are typically in verticals that require data sovereignty and/or have mission-critical applications such as defense.

Network edge platforms

Network edge seeks to offer multiple customers access to a shared infrastructure. These Infrastructure-as-a-service (IaaS)- or Platform-as-a-service (PaaS)-type platforms can offer distributed compute and storage capabilities. This provides the ability to develop applications on edge infrastructure, and network services, in a self-serve way at the network edge. Combining edge with (third party, public) cloud resources enables a distributed cloud platform. Customers for these could include enterprise customers, as well as a developer ecosystem who can then use these services to develop, deploy and manage their applications at the edge. Operators who already have experience offering IoT or API platforms, or private cloud, are best positioned to offer network edge platforms.

Multi-edge and cloud orchestration

As enterprises increasingly adopt multi-cloud, the edge only serves to further fragment the distribution of workloads. Enterprises need a solution to manage this complexity whether across applications, workloads, and infrastructure across their on-premise edges, network edge, and private and/or public cloud. The target customer base could be, for example, those who must comply with strict data privacy laws and will have to migrate their workloads to meet local data sovereignty requirements. An operator that can offer a single pane of glass to monitor the different moving parts will provide significant value to this customer segment.

Vertical solutions

This service involves offering a full end-to-end solution that combines networking, edge computing, applications, and services. The edge in this situation can be very heterogeneous and can take many different forms (an on-premise data center, customer premises equipment, a hyperscaler, or third-party edge). Operators can then also offer managed services on top and if available, complementary capabilities such as an existing analytics platform or help customers assemble the applications themselves. As a result, these services would usually be quite tailored, complex, and vertical-specific. Hence this service is typically provided by incumbents who have extensive expertise, partner ecosystems, and a strong understanding of specific verticals.

Capturing new value will not be easy

Growing edge in the enterprise segment will be a fundamental step in revenue diversification for operators globally. However, the challenges that each operator faces will vary depending on where they currently stand and where their priorities have been in the past. To truly capture the enterprise opportunity, operators must first take a step back and reflect on their existing position – do they currently have a strong relationship with enterprises? Do they have the channels and skills required to deliver these services? Is the technology needed to meet their ambitions already part of their portfolio and is it mature enough? It is then evident that the first step is understanding themselves before they can develop a winning strategy.

About the author

Richard Lim is a consultant at STL Partners specializing in telco cloud, edge computing, and 5G. STL Partners’ new report, “Growing B2B revenues from edge: Five new telco services,” is sponsored by CloudMC.

DISCLAIMER: Guest posts are submitted content. The views expressed in this blog are that of the author, and don’t necessarily reflect the views of Edge Industry Review (EdgeIR.com).

5G Open Innovation lab tackles edge apps for Smart Ag

Article Topics

B2B | edge computing | multi-cloud | network edge | private network | STL Partners | telecoms

Comments