Ampere will design chip to power the hyperscale cloud market, distancing itself from ARM’s edge strength

Ampere, the start-up looking to challenge Intel’s dominance in the data center, recently held its annual media day. The semiconductor company took the opportunity to share its roadmap and some new customers such as Microsoft and Tencent. But what caught the market’s notice was the news that Ampere is to move away from long-term partner ARM, in an audacious bid to capture the hyperscale cloud market.

Up to now, Ampere has been using ARM designs for its chips. ARM chips, found in every iPhone, are power efficient and can be scaled up to large numbers of cores. They are widely used in edge devices, where x86 chips are at disadvantage because of the heat they generate through greater power usage. Hence Ampere’s 80 core Altra and (from later this year) 128-core Altra Max offer better performance at a lower cost than rival chips from Intel and AMD.

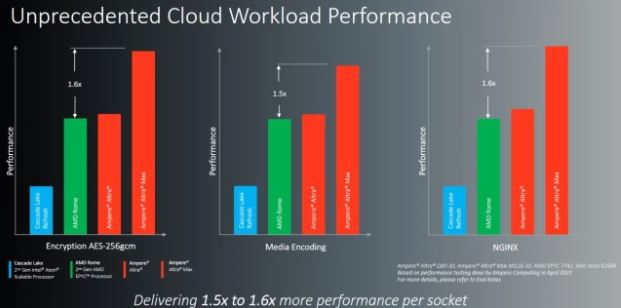

Ampere touts performance advantages over competitors for a variety of workloads. Source: Ampere

Starting from next year Ampere will take its chip design in-house, although the new series will remain compatible with the ARM architecture. Ampere is doing this because it’s targeting the specific requirements of hyperscale cloud providers like AWS. Ampere’s Cores will feature high I/O memory bandwidth optimized for cloud use cases rather than high-performance computing, to date the use case for this type of chip. Ampere is also committing itself to yearly product releases, which is exactly what demanding cloud customers will want to give them a competitive edge versus their rivals.

Analysis

While ARM is strong at the edge, up to now, Intel and x86 chips have the lion’s share of the data center and public cloud market. There aren’t many ARM data center chips available and in public cloud service, just AWS Graviton and a rumored Microsoft ARM server are the exceptions.

Ampere’s move makes strategic sense because of the planned acquisition of ARM by Nvidia. Nvidia GPUs have carved a niche in cloud computing for AI workloads, and the company wants to continue to make inroads in the data center market. Plotting out a distinct but compatible path, if successful, opens up acquisition possibilities for Ampere—including Nvidia if the ARM deal is nixed by regulators, for instance.

Another big obstacle: hyperscale cloud providers themselves have the resources to innovate at the chip level, and AWS and Google plan to do just that. Ampere’s move is certainly ambitious, and its success relies on Ampere being able to design cheaper and better chips than Google, Amazon and Intel. That is a big ask, but the strategy is well thought out and appears to be gaining traction. It would be foolish to dismiss Ampere’s chances prematurely.

Jim Davis, Principal Analyst, Edge Research Group, contributed to this report.

5th IoT Global Innovation Forum

Article Topics

Ampere | ARM | AWS | Azure | chip | cloud | data center | edge processor | Google | GPU | hyperscale | Microsoft | Nvidia

Comments